tax loss harvesting crypto

With us you can track gains calculate taxes and generate tax forms. This can be adjusted based on certain deductibles and expenditures.

.png)

The Complete Guide To Crypto Tax Loss Harvesting

There are safer ways to harvest losses on a crypto asset.

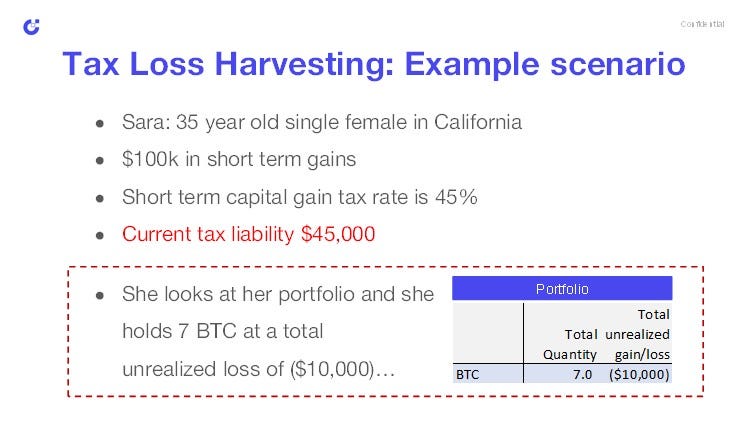

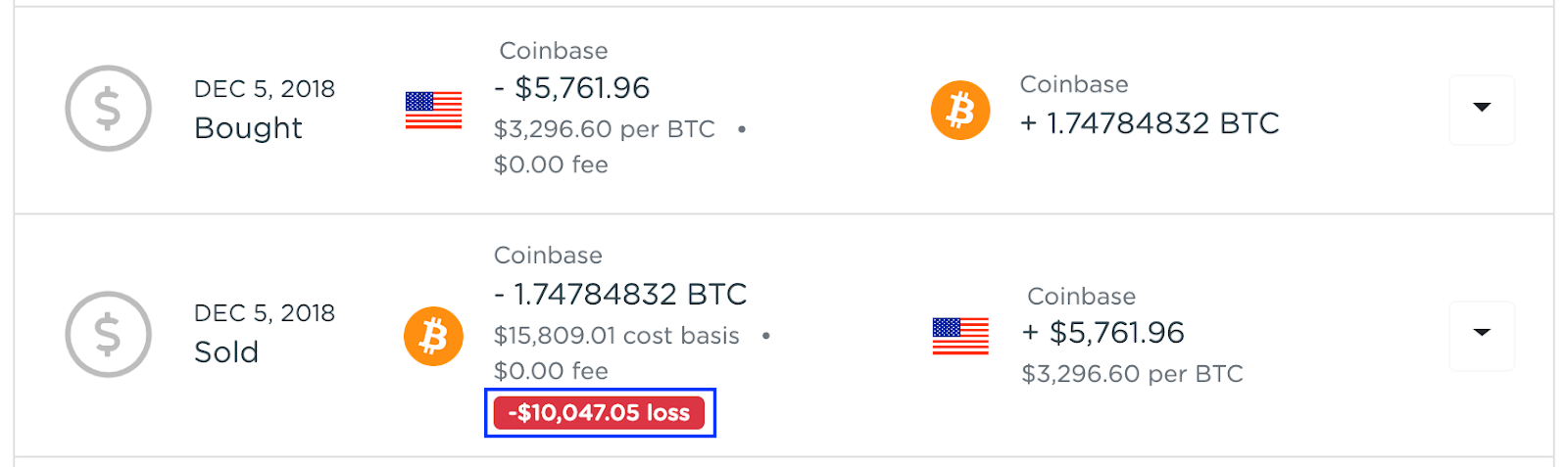

. A wash sale is one of the key pitfalls to avoid when trying to take advantage of tax-loss harvesting to reduce your taxes and in falling markets such as in 2022 it can be valuable to make sure. This essentially means that active crypto traders can book their losses harvest the loss and immediately buy back into the crypto. Look for tax-loss harvesting opportunities.

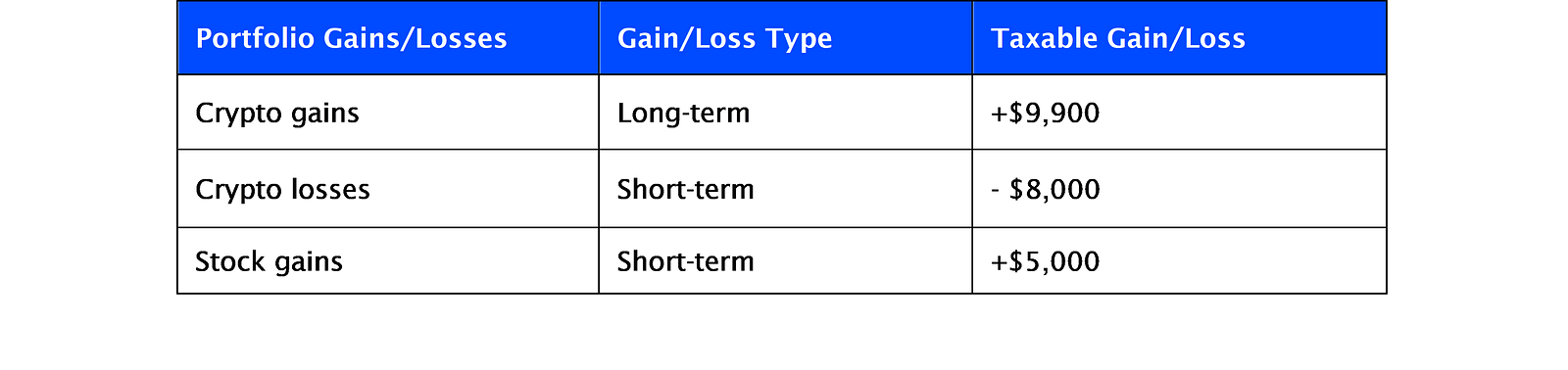

When offsetting your capital gains with losses pay attention to the holding period of the assets. Professional portfolio managers like Fuse who specialize in this area even build portfolios with their tax strategy in mind. Stock Market 101.

As well as take advantage of the lack of wash sale rule using tax-loss harvesting. If you work in the same state as your employer your income tax situation probably wont change. Finally you can start for free for five wallets and switch to paid tiers for more.

Everything you need to know to get started with tax-loss harvesting and save money on your crypto tax bill. Investing can be complicated even when you build a relatively simple portfolio of mutual funds and exchange-traded funds ETFsDeciding on the right asset allocation choosing the best securities to invest in monitoring your performance and rebalancing your portfolio takes effort. Free crypto tax forms for individuals.

To avoid a wash sale one approach is to trade the depreciated asset for a coin with which its price is closely correlated. With the wash sale rule and its lack of application to crypto here to stay for now crypto investors can take advantage of tax loss harvesting strategies for crypto. The first-ever Big Four-grade ERP solution for digital assets accounting.

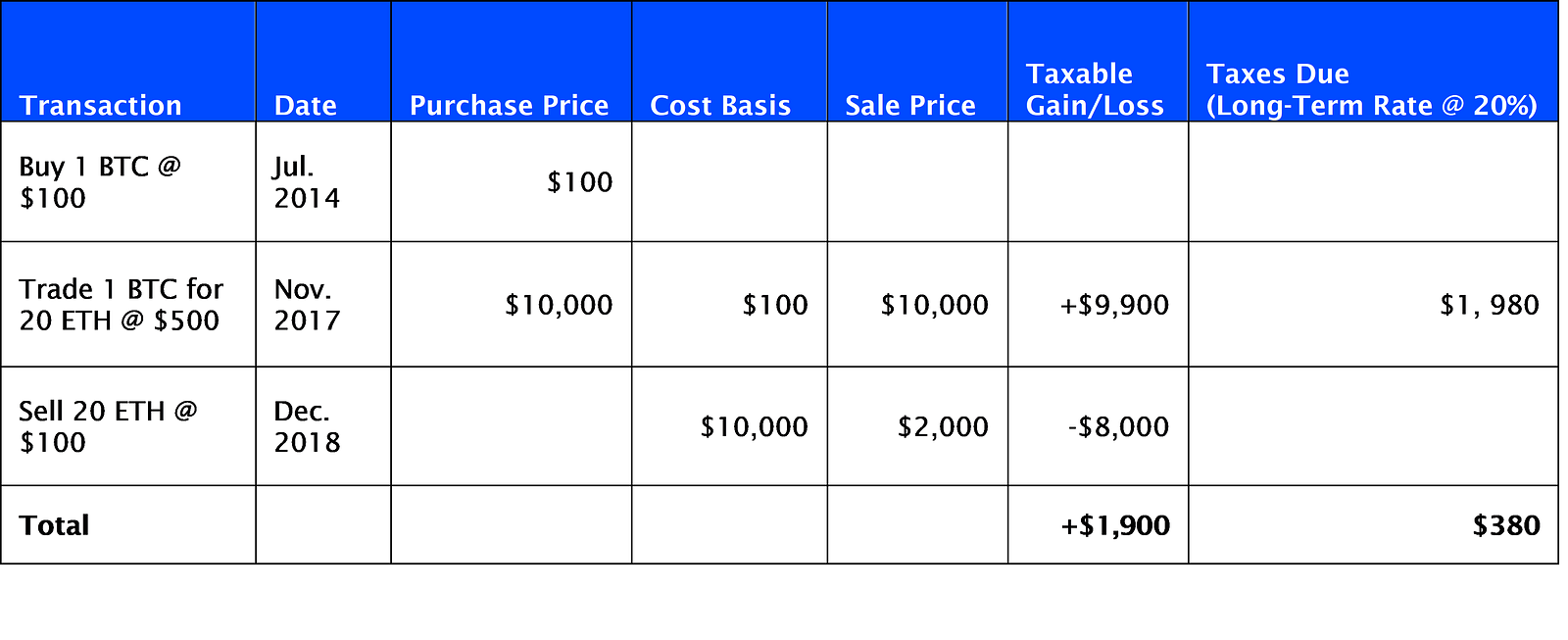

All the forms you need. With this strategy you can use your loss to offset the profit youve made on other crypto or stocks reducing the amount of taxes you owe. Tax-Loss Harvesting IRS Forms Capital Gains Report TurboTax integration.

It does not currently apply to crypto but future laws may change. Tax-loss harvesting is an advanced investing strategy you can use to reduce your tax bill. Save on Capital Gains Tax with lot-level tax-loss harvesting data.

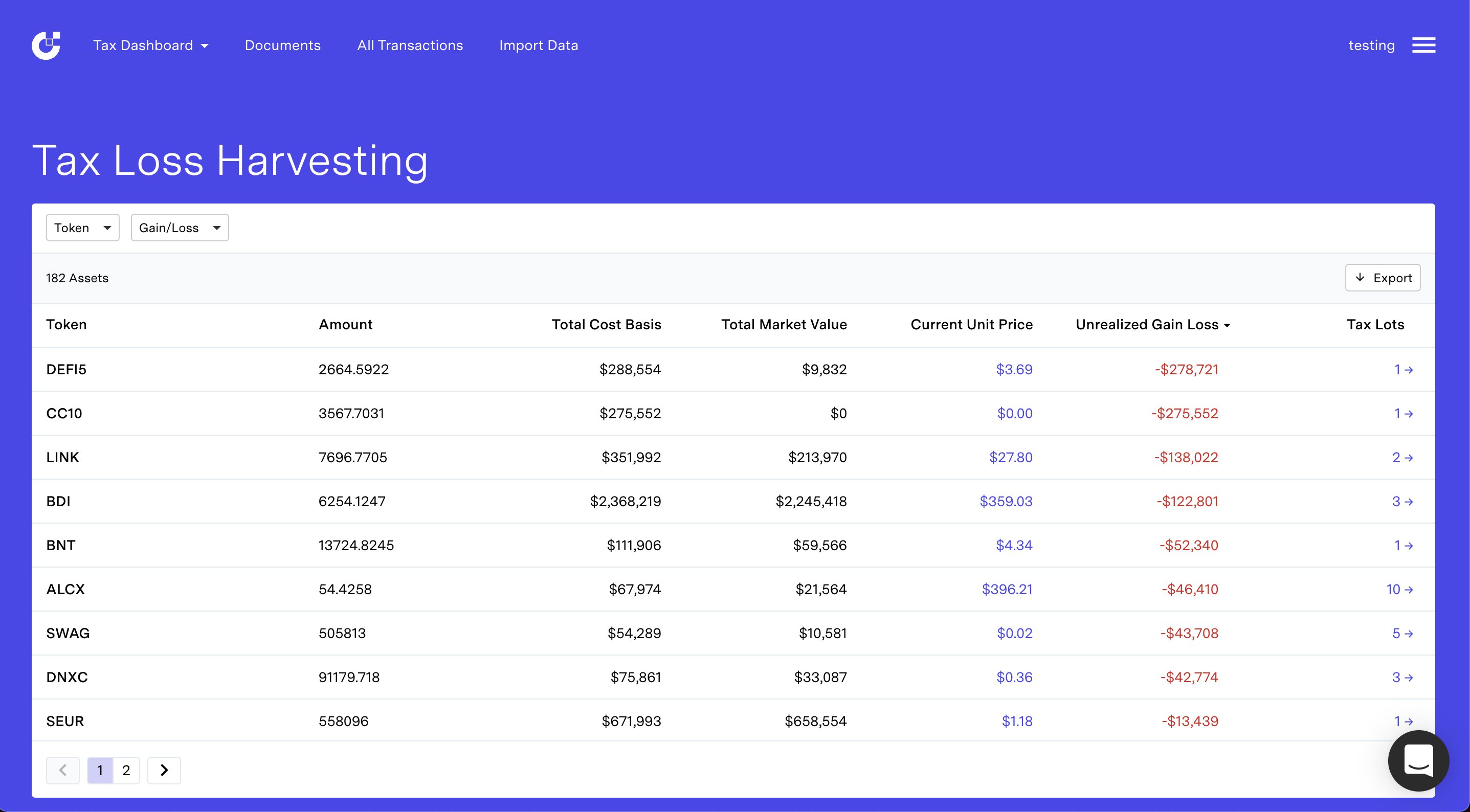

Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins. With automatically generated tax forms and reports like our crypto tax loss harvesting dashboard youll save time stay prepared and make more strategic tax decisions. Aside from that you can also consider buying crypto via an IRA Individual Retirement Account.

We enable and ensure regulatory compliance. A tax-saving strategy called tax-loss harvesting relies on reporting your crypto losses to offset gains. Tax-loss harvesting for example involves intentionally selling some of your crypto at a loss to offset gains youve made on other sales.

The best way to maximize the value of tax-loss harvesting is to incorporate it into your year-round tax planning and investing strategy. The Ultimate Crypto Tax Guide 2022. The Martingale strategy is a trading strategy that involves doubling your next bet every time you take a loss.

Tax-loss harvesting can reduce your taxes and also encourage you to get out of losing investments before they fall even further in value. Get Started For Free. Find out how it works for crypto in this article.

Crypto taxes done in. But if you start working remotely full-time across state lines you may have to file and pay tax in two states. Calculate Your Crypto Taxes.

How Tax-Loss Harvesting Works. Everything you need to know to get started with tax-loss harvesting and save money on your crypto tax bill. Savvy crypto traders often sell assets at an intentional loss to take advantage of this strategy.

If you rebuy a crypto asset after the 30 day period passes your actions no longer classify as wash sale trading. Form 1099 solutions for institutions. Best Crypto Apps Stock Market Basics.

In what some call a crypto winter here are some of the top cryptos for risk-tolerant investors to watch. The strategy known as tax-loss harvesting allows you to sell declining assets from your brokerage account and use the losses to reduce other profits. No credit card needed.

ZenLedger is the best crypto tax software. Crypto tax software but also a full-service crypto tax accounting firm. Dubbed the rocket fuel of crypto DeFi makes it possible for speculative investors to lend crypto and potentially reap big rewards when the proprietary coins DeFi borrowing.

Get Started For Free. But failing to report income from crypto trades could get you in trouble. The wash sale rule is created to prevent people from exploiting tax-loss harvesting benefits.

The Best Crypto Exchanges Best. Crypto taxes done in. You get performance charts by date and crypto with the added benefit of daily portfolio updates.

It shows real-time market value optimizes for cost basis accounting and supports tax-loss harvesting. Your cost basis is the amount you spend in order to obtain your crypto including fees and other acquisition costs. Once losses exceed gains you can use the.

Our crypto tax tool supports over 400 exchanges Coinbase tracks your gains and generates tax forms for free. No credit card needed. Make tax-loss harvesting part of your year-round tax and investing strategies.

Tax loss harvesting. Calculate Your Crypto Taxes. However the following are the most common working remotely tax implications to know about.

In fact by keeping careful track of your returns you can potentially save money using a method called tax loss harvesting. The Ultimate Crypto Tax Guide 2022. How much tax you owe on your crypto depends on how much you spend or exchange your income level and tax bracket and how long you have held the crypto you used.

Safer crypto tax loss harvesting. End-to-end data reporting and transaction reconciliation.

.png)

The Complete Guide To Crypto Tax Loss Harvesting

![]()

2022 Crypto Tax Loss Harvesting Guide Cointracker

Save Big With Cryptocurrency Tax Loss Harvesting Cointracker

Tax Loss Harvesting For Crypto Youtube

Crypto Tax Loss Harvesting Surviving Through The Bear Market Bybit Learn

![]()

2022 Crypto Tax Loss Harvesting Guide Cointracker

Tax Loss Harvesting How To Get Part Of The Money You Lost In Crypto Back From The Irs By Alex Miles Tokentax Medium

How Crypto Tax Loss Harvesting Works And Why You Should Do It Prismatic Investments

Crypto Tax And Portfolio Software Cointracker

Crypto Tax Loss Harvesting A Complete Guide R Taxbit

Tax Loss Harvesting Understanding The Basics

Find The Best Crypto Tax Software For Reporting Your 2021 Taxes

The Essential Guide To Crypto Tax Loss Harvesting Tokentax

![]()

2022 Crypto Tax Loss Harvesting Guide Cointracker

The Complete Guide To Crypto Tax Loss Harvesting

Save Big With Cryptocurrency Tax Loss Harvesting Cointracker

How To Tax Loss Harvest With Cointracker Cointracker